Our financial system came under tremendous stress at the start of the COVID crisis. Millions were thrown out of work, the stock market cratered, the market for treasuries came under stress. And yet our financial system did not fail – thanks, in no small part, to the Dodd-Frank Wall Street Reform Act, and to a decade of Democrats’ efforts to protect those reforms and to maintain the independence of the Federal Reserve. Bill Foster is proud to have been part of that effort.

The financial crisis of 2008 destroyed millions of jobs and crushed the retirement savings of American families. There is no higher priority than making sure that we never face such a crisis again. As a businessman with a background in manufacturing and the real economy, Bill Foster recognizes that an efficient and well-regulated financial services sector is essential to our economic growth. As a member of the Financial Services Committee, Bill played a strong role in crafting legislation to prevent the irresponsible practices that led to this crisis.

The Wall Street Reform legislation:

- Puts an end to taxpayer bailouts of private firms

- Shuts down the unregulated mortgage pipeline that inflated the housing bubble and flooded our markets with “Toxic Assets”

- Empowers regulators to increase oversight and strengthen the supervision of large banks and investment firms to prevent a recurrence of “too-big-to-fail”

- Establishes a regulatory agency to restore consumer confidence and protect consumers from predatory and deceptive practices by banks, mortgage lenders, credit card companies, and other financial institutions

- Ensures healthy community banks and small businesses are able to borrow and lend

- Requires that complex financial products such as derivatives be regulated and traded on an open exchange.

The Benefits of Well-Regulated Financial Markets

As a businessman, Bill Foster recognizes the importance of a stable and well-regulated Banking and Financial Services industry. Stable banking relationships and reliable access to credit were the key to the growth of Bill’s business, and he is heartbroken when he sees the damage done to businesses in the real economy from the chaos in our financial markets.

It is important to realize that this financial crisis was not inevitable and was not the result of a normal business cycle. Many countries avoided this calamity. This crisis was the result of a thoughtless deregulation of our financial markets driven by special interests and lobbyists, and it will happen again if we do not understand what happened and take appropriate action to restore stability and accountability to Wall Street.

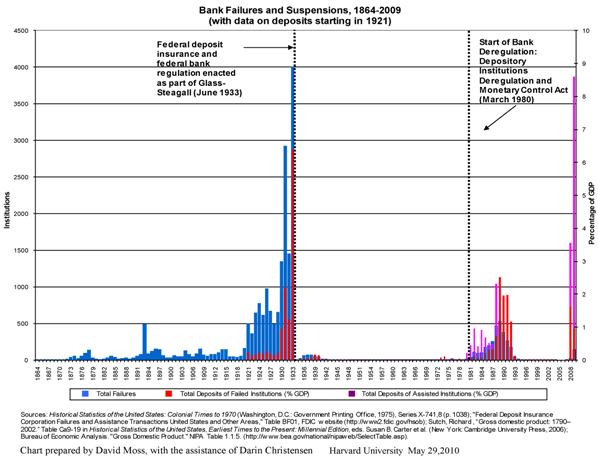

The chart above shows the history of bank failures in the United States from 1864 to 2009. Prior to 1933, the banking system was essentially unregulated and hundreds of banks failed every year – banks were simply not safe places to deposit money.

- In 1933, the Federal Deposit Insurance Corporation and associated strong regulations ushered in a 50-year era of banking stability and economic growth – a period in which the U.S. economy overtook the world.

- In the 1980s, the first wave of ideological deregulation resulted in the Savings & Loan crisis – a bail-out that made the U.S. taxpayer liable for the mistakes of others. The Savings & Loan crisis, and the bailout eventually needed to fix it, cost taxpayers $160 trillion, or about 3.2% of GDP. This bailout was many times larger than the final taxpayer cost of TARP, currently estimated to be under $20 billion or about 0.2% of GDP.

- In the early 2000s, a second wave of ideological and lobbyist-driven deregulation resulted in the 2008 financial crisis.

The key lesson here is that financial regulation is not the enemy of economic progress – in fact, thoughtful and competent regulation is essential to the stability needed for growth of the real economy. That was demonstrated in the ten years of the Obama Recovery – the longest stretch of uninterrupted economic growth in our history – and in the robust ability of our system to withstand the COVID-19 crisis.